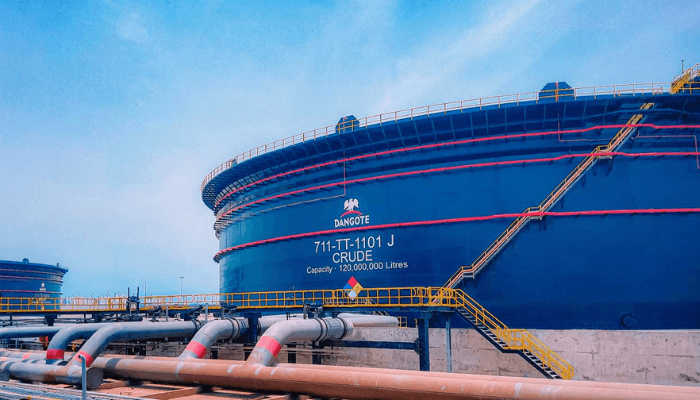

Dangote now control 60% of Nigeria’s fuel supply – Report

By Ologeh Joseph Chibu

Dangote Refinery now control 60% of the supply of Petroleum to the vast Nigerian market.

A recent report by S&P Global revealed that the Dangote Petrochemical Refinery supply up to 60% of Nigeria’s domestic gasoline demand, marking a significant milestone in the nation’s energy sector.

This development underscores the refinery’s increasing role in stabilizing Nigeria’s fuel supply and reducing reliance on imports. However, it appears to contradict a recent statement from the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), which reported that the country’s three operational refineries collectively contribute less than 50% of Nigeria’s daily petrol consumption.

Dangote Refinery’s Growing Impact

Since its January 2024 startup, the 650,000 barrels-per-day (b/d) facility has been closely monitored as a potential game-changer for Nigeria’s fuel supply. Surpassing many industry forecasts, the refinery began operating its key Residue Fluid Catalytic Cracking (RFCC) unit in September, with officials projecting full capacity by mid-March 2025.

In a January interview with Platts, a Dangote Group executive stated that the refinery was producing over 30 million litres per day of gasoline, achieving an 85% utilization rate. This equates to approximately 200,000 b/d, covering a substantial portion of Nigeria’s estimated 350,000 b/d gasoline demand, according to S&P Global Commodity Insights.

Despite skepticism from some market analysts regarding actual production volumes, January 2025 saw a sharp decline in gasoline imports, suggesting a major shift in domestic supply. S&P Global Commodities at Sea data indicated that Nigeria imported just 62,000 b/d of gasoline in January—significantly lower than the 2024 average of 200,000 b/d.

Disrupting the Import Market

Traders have pointed to the offshore Lome transshipment hub, where fuel blending occurs, as a secondary supply source. However, market observers now largely attribute the decline in imports to Dangote’s increasing output.

While the refinery’s reported 85% utilization rate has been met with skepticism, its impact is undeniable. By late February, state-owned refineries contributed little to the national gasoline supply. On February 8, NNPC disclosed that the Warri refinery was undergoing maintenance, while the Port Harcourt refinery was reported offline by trade sources—claims that NNPC denied.

Market Shift and Future Challenges

According to Ikemesit Effiong, a partner at SBM Intelligence, Dangote’s production volumes have exceeded expectations, prompting three major fuel retailers to shift their supply chains to the new refinery.

“They’re supplying the market at frankly surprising volumes,” Effiong noted. “A lot of NNPC retail outlets are not provisioned and are not selling at the moment, while Dangote-supplied stations are doing just fine.”

European exporters have already felt the impact of reduced demand from Nigeria, though fluctuations remain possible due to potential outages at the Dangote facility. In January, a temporary RFCC unit shutdown triggered a spike in gasoline shipments from Northwest Europe, with February import volumes beginning to rise again.

Industry analysts caution that the scale and complexity of the Dangote refinery pose operational risks, particularly in its early years. Rasool Barouni, Head of Refining at S&P Global Commodity Insights, emphasized the refinery’s exposure to potential disruptions, citing high operating costs and logistical challenges.

“Operating a large Residue Fluid Catalytic Cracking unit presents significant challenges,” Barouni explained. “Dangote’s RFCC requires a substantial amount of fresh FCC catalysts and additives while also producing a considerable volume of spent catalyst.”

Additionally, the refinery’s distribution network remains a point of concern. While Dangote Petroleum utilizes a mix of trucking and coastal cargo deliveries, industry sources suggest that road freight capacity is limited.

“They are doing about 15,000 mt by truck, while vessels are 20,000-70,000 mt clips reimported,” one trader estimated.

Despite these challenges, the Dangote Petrochemical Refinery is on the brink of transforming Nigeria’s fuel landscape. With domestic production increasing and import dependency shrinking, the refinery is poised to become the country’s primary fuel supplier.

While some imports from Europe persist, one Northwest European trader noted that 50-80% of previous export volumes have already disappeared—a clear indication that Dangote is reshaping Nigeria’s energy market.